Commercial Banking Functions

For these services banks charge some commission from their clients.

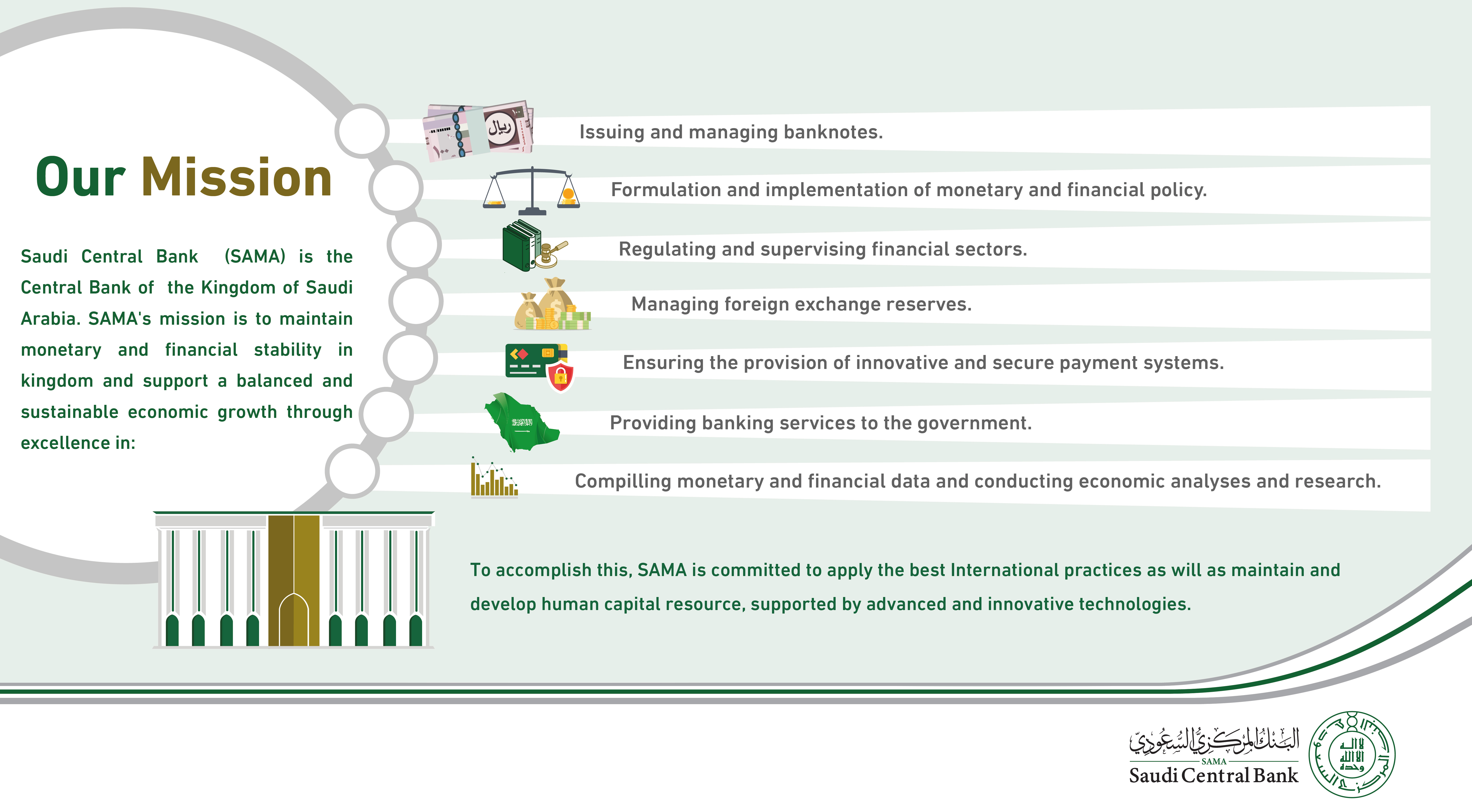

Commercial banking functions. However besides these functions there are many other functions which these banks perform. A commercial bank is a profit based financial institution that grants loans accepts deposits and offers other financial services such as overdraft facilities and electronic transfer of funds. The main functions of commercial banks are accepting deposits from the public and advancing them loans. Commercial banking is the most significant portion of modern banking system.

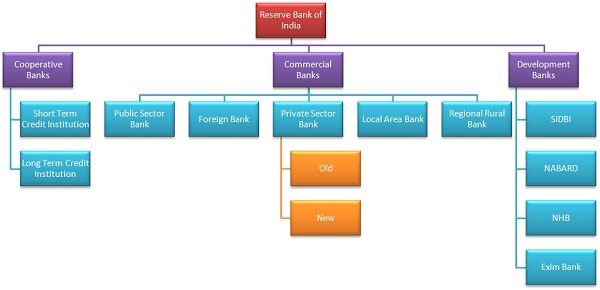

Commercial banking is a vital part of economic growth because it permits investment through financing. All these functions can be divided under the following heads. Commercial banking is basically the parent of all types of banking available in the present banking structure. Saving deposits current deposits and fixed deposits.

A bank is also a place where money and other valuables are kept. For these services banks charge some commission from their clients. Definition function credit creation and significances. A bank can be defined as a financial institution that provides various financial services which may include accepting deposits and issuing loans.

The deposits may be of three types. The most significant and traditional function of commercial bank is accepting deposits from the public. A commercial bank can be defined as the financial institution that offers banking services to the general public and to companies. The following are the major functions of commercial banks acceptance of deposits.

Meaning of commercial banks. Commercial banks are the most important components of the whole banking system. Meaning of a commercial bank. In order to understand the role of commercial banking let us discuss some of its major functions.

Commercial banks also perform certain agency functions for their customers. In fact commercial banks as their name suggests axe profit seeking institutions ie. A commercial bank is a financial institution which performs the functions of accepting deposits from the general public and giving loans for investment with the aim of earning profit. If investment was only possible through money already saved by the investor growth would be.

In case of current account people can withdraw deposits in part or in full at any time he likes without notice.